A controversial insurance program launched by the National Rifle Association is now under investigation in New York state. The program, called Carry Guard, consists of advanced self-defense firearms training, along with insurance protection for eligible legal costs incurred after shooting another person. “Without insurance, lawful self-defense can cost a fortune,” says the program’s website.

The NRA introduced Carry Guard in April, shortly before the group’s 2017 Annual Meeting in Atlanta. The insurance portion is underwritten by the insurance industry giant Chubb, and administered by a third company, Lockton Affinity.

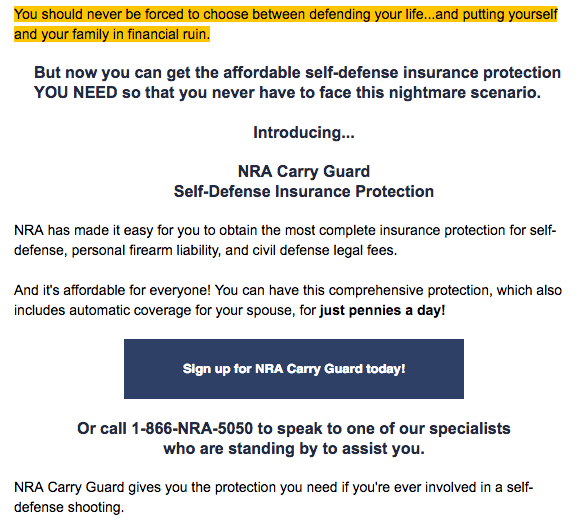

Through email, YouTube, and social media, the NRA has aggressively promoted Carry Guard. “You should never be forced to choose between defending your life…and putting yourself and your family in financial ruin,” one promotional email from the organization reads, before instructing potential buyers to “Sign up for NRA Carry Guard today!”

A New York statute stipulates that only licensed insurance agents and brokers may solicit business in the state. The New York State Department of Financial Services confirmed to The Trace that the NRA does not have a license to sell or distribute insurance in New York.

The Wall Street Journal reported on Tuesday that the department had opened an official probe into the NRA’s actions concerning Carry Guard. The investigation follows a legal review conducted by Everytown for Gun Safety and distributed to regulators in both New York and California. (Everytown provides a portion of The Trace’s funding.)

At The Trace’s request, Peter Kochenburger, the deputy director of the Insurance Law Center at the University of Connecticut, reviewed a selection of the content that the NRA has distributed on Carry Guard.

“When I look at New York law, it looks like the NRA’s promotion of Carry Guard crosses into solicitation,” Kochenburger said.

Contact Us

Learn how to contact our reporters securely.

In New York, groups like the NRA are allowed to put their names on insurance products and endorse them. What the law prohibits is direct insurance salesmanship by unlicensed parties, a version of a standard that is followed by a majority of states.

In 2001, New York insurance regulators set down guidelines for what constitutes direct solicitation, defining it to mean “to ask for the purpose of receiving,” or “to move to action, to endeavor to obtain by asking, and implies personal petition to a particular individual to do a particular thing.”

The ongoing investigation will focus in part on whether the NRA’s communications regarding Carry Guard constitute one or more of those prohibited actions.

Materials that the state’s Department of Financial Services may review include emails that the NRA sent to members concerning Carry Guard. One of those emails, sent in August, contains the following language:

The NRA has also publicized Carry Guard on YouTube. A video focused on its self-defense insurance aspect features the NRA spokeswoman Dana Loesch, who says into the camera, “Protect yourself. Get Carry Guard.”

If New York regulators determine that the NRA is indeed urging customers to purchase Carry Guard insurance, they may issue a cease-and-desist letter that would require the gun-rights group to immediately stop marketing the product to New Yorkers.

The state’s probe also includes a second line of inquiry, regarding whether the NRA is improperly profiting from Carry Guard.

The Department of Financial Services has sent subpoenas to the NRA and Lockton Affinity, along with a letter to Chubb, asking for documentation on the way fees are collected after the sale of Carry Guard policies, as well as information on the program’s promotional activities. Chubb told The Trace that it will “provide a timely response” to the department’s request, and Lockton Affinity said that it is “cooperating fully” with the investigation. The NRA declined to comment.